Configuring ComplyAdvantage

ComplyAdvantage is a data provider you can use to run these checks:

PEPs and sanctions screening for individuals

Sanctions and adverse media screening for companies

PEPs and sanctions screening for individuals

How it works

This is the default behavior for a variant of the PEPs and sanctions screening check with ComplyAdvantage as the data provider.

The check is performed by screening an individual’s name and, when available, date of birth and nationality through ComplyAdvantage’s sources to provide a list of the individual’s potential matches to sanctions and politically exposed persons (PEPs).

To learn about how ComplyAdvantage classifies PEPs and sanctions, see the help site for ComplyAdvantage.

If no potential matches are found for the individual, and the individual doesn't have potential matches returned from earlier screening checks, the check is marked Completed.

If any potential matches are found, the check returns Unresolved events and the matches are displayed in the check results. By default, all matches are displayed in the Potential matches list.

For every match that’s discovered, a detailed portfolio is displayed. This portfolio provides all available information from ComplyAdvantage about the match’s biography, associates, political exposure, events, and sources.

This check variant is supported for all countries.

Tip

To reduce false positives, provide the individual’s date of birth and nationality where possible.

Any false positives filtered out by ComplyAdvantage aren’t displayed at all in Maxsight. Contact ComplyAdvantage for more information about how they determine false positives and where you can see them.

By default, ComplyAdvantage only returns results with the same number of names as the profile. For example, a profile named Alex Darcy Wheeler will not return a potential match called Alex Wheeler because the profile has three names and the potential match has two names. To change this, you can set a custom search setting on your ComplyAdvantage account called name_variations. For help setting up this custom search setting, please speak to your ComplyAdvantage account manager.

Maxsight will process a maximum of 100 potential matches, this is because ComplyAdvantage doesn't monitor searches with more than 100 matches. If there are more than 100 potential matches, the check will show an error and you will need to refine your search or view the matches through your data provider's portal.

Configuration options

You have the following configuration options:

ComplyAdvantage fuzzy match configuration for names: This option is required. Insert a value between 0.0 as an exact match to 1.0 as a loose match. The value here should match the settings you’re using for your ComplyAdvantage account. To get more information about this value or your account settings, please contact your ComplyAdvantage account manager.

Enable ongoing monitoring: When this option is selected, any time a new match is discovered by ComplyAdvantage, the check’s task is marked incomplete, and, if the profile’s application is approved, it’s put into review. When this option is deselected, new matches are only returned from ComplyAdvantage when a user runs the check manually or, if your policy specifies, when a new task version is added to the application. Learn more about monitored applications.

When ongoing monitoring is enabled, any new matches are updated and displayed in Maxsight as soon as ComplyAdvantage sends them.

Send customer reference: When this option is selected, Maxsight sends the Customer reference from the profile data to ComplyAdvantage, which ComplyAdvantage then uses as their

client_refduring the search. You could, for example, use the Customer reference to store your own unique identifier for the customer so when ComplyAdvantage performs the search, it's easier to identify the customer across platforms, reduce duplicated work, and simplify your processes.Include adverse media matches: When this option is selected, Maxsight displays instances of adverse media returned from ComplyAdvantage.

This option should only be selected if you have adverse media configured on your ComplyAdvantage account. If you select this option and adverse media is not configured on your ComplyAdvantage account, this check cannot run successfully and error messages are displayed.

To learn about how ComplyAdvantage classifies adverse media, see the help site for ComplyAdvantage.

Ignore historical matches: When this option is selected, Maxsight removes any matches that ComplyAdvantage previously listed as politically exposed or sanctioned but are not on any current lists.

Name settings for false positive reduction: This required option is one of three that contributes to Maxsight’s false positive reduction service. It determines how Maxsight treats results returned from ComplyAdvantage when a result’s name does not match the name on the profile. The value for the option must be one of the following: Allow any matches, Allow close or exact matches, or Allow exact matches.

Date of birth settings for false positive reduction: This is one of three options contributing to Maxsight's false positive reduction service. It determines how Maxsight treats results returned from ComplyAdvantage when a result’s date of birth does not match the profile’s date of birth. The value for the option must be one of the following: Allow any matches, Allow close or exact matches, or Allow exact matches.

If the profile doesn’t have a date of birth, for example, if the field was left blank, date of birth is not used as a factor in identifying false positives.

Nationality settings for false positive reduction: This is one of three options contributing to Maxsight’s false positive reduction service. It determines how Maxsight treats results returned from ComplyAdvantage when a result’s country of nationality does not match the profile’s country of nationality. The value for the option must be one of the following: Allow any matches, Allow close or exact matches, or Allow exact matches.

If the profile doesn’t have a country of nationality, for example, if the field was left blank, country of nationality is not used as a factor in identifying false positives.

Note

To turn off Maxsight’s false positive reduction service, set the , , and options to Allow any matches.

ComplyAdvantage search profile configuration: Add the name of a ComplyAdvantage search profile, and the associated search filters, and any other configurable options, are applied by ComplyAdvantage to reduce false positive. This is optional with a direct agreement.

Caution

The name of a provider configured search profile cannot be used with the Include adverse media matches configuration option.

What we’ll need

Let us know that you’d like to add a PEPs and sanctions screening check variant with ComplyAdvantage and let us know which configuration options you’d like to use. We’ll set it up for you.

We'll also need you to:

Send us your ComplyAdvantage API key.

Create a ComplyAdvantage webhook with the URL we’ve sent you.

Learn how to get your API key and create a webhook.

Testing your configuration

Once the check variant is configured, follow these steps in your demo environment to test whether it's working as expected.

Does the check complete when no matches are returned from ComplyAdvantage?

To run the test, create an individual profile, with no other potential matches returned from previous screening checks, and run the check variant. If the check is marked Completed and there are no potential matches displayed in the check results, it’s working as expected.

Do the check results display PEPs matches returned from ComplyAdvantage?

To run the test, create an individual profile with "Hugo" as the first name and "Chavez" as the surname, and run the check variant. If the check status is Unresolved events and there are PEPs matches displayed in the check results, it’s working as expected.

Do the check results display sanctions matches returned from ComplyAdvantage?

To run the test, create an individual profile with "Bashar" as the first name and "Assad" as the surname. If you're using any false positive reduction configuration options, ensure the date of birth is 11 September 1965. Run the check variant. If the check status is Unresolved events and there are PEPs and sanctions matches displayed in the check results, it’s working as expected.

When the check is configured to include adverse media results:

Do the check results display adverse media matches returned from ComplyAdvantage?

To run the test, create an individual profile with "Robert" as the first name and "Mugabe" as the surname, and run the check variant. The check status should be Unresolved events and matches should be displayed in the check results. If, when you click the names of the matches, there are adverse media results displayed under Sources, it's working as expected.

When ongoing monitoring is configured:

To see what happens when new results are returned during ongoing monitoring, follow the API steps in Test ongoing monitoring using the API.

The data returned is demo data only.

Profile fields

These are the profile details searched in ComplyAdvantage's sources:

Name | Description |

|---|---|

First name(s) ( *Required | The individual’s first and, if applicable, middle names. |

Surname ( *Required | The individual’s last name. |

Date of birth ( Optional | The individual’s date of birth. |

Nationality ( Optional | The individual’s country of nationality. |

Customer reference ( Optional | The individual's customer reference which ComplyAdvantage uses as their |

Sanctions and adverse media screening for companies

How it works

This is the default behavior for a variant of the Sanctions and adverse media screening check with ComplyAdvantage as the data provider.

The check is performed by screening a company’s name and country of incorporation through ComplyAdvantage’s sources to provide a list of the company’s potential sanctions matches and, if you have access to ComplyAdvantage’s PEPs results, PEPs matches.

Individuals who are company associates, for example, shareholders and officers, are not screened as part of this check. To screen individuals automatically, create an associate smart policy for the task with a screening check for individuals. Learn how company associates are approved/rejected using associate smart policies. To learn about how ComplyAdvantage classifies PEPs and sanctions, see ComplyAdvantage's documentation .

.

If no potential matches are found for the company (and the company doesn't have potential matches returned from earlier screening checks), the check is marked Completed .

If any potential matches are found, the check returns Unresolved events and the matches are displayed in the check results. By default, all matches are displayed in the Potential matches list.

For every match that’s discovered, a detailed portfolio is displayed. This portfolio provides all available information from ComplyAdvantage about the match’s biography, associates, political exposure, events, and sources.

This check variant is supported for all countries.

Any false positives filtered out by ComplyAdvantage aren’t displayed in Maxsight. Contact ComplyAdvantage for more information about how they determine false positives and where you can see them.

A maximum of 200 potential matches can be processed. If there are more than 200 potential matches, they won't be displayed in Maxsight. Please refine your search or view the matches through your data provider's portal.

Configuration options

You have the following configuration options:

ComplyAdvantage fuzzy match configuration for names: This option is required. Insert a value between 0.0 as an exact match to 1.0 as a loose match. The value here should match the settings you’re using for your ComplyAdvantage account. To get more information about this value or your account settings, please contact your ComplyAdvantage account manager.

Enable ongoing monitoring: When this option is selected, any time a new match is discovered by ComplyAdvantage, the check’s task is marked incomplete, and, if the profile’s application is approved, it’s put into review. When this option is deselected, new matches are only returned from ComplyAdvantage when a user runs the check manually or, if your policy specifies, when a new task version is added to the application. Learn more about monitored applications.

When ongoing monitoring is enabled, any new matches are updated and displayed in Maxsight as soon as ComplyAdvantage sends them.

Send customer reference: When this option is selected, Maxsight sends the Customer reference from the profile data to ComplyAdvantage, which ComplyAdvantage then uses as their

client_refduring the search. You could, for example, use the Customer reference to store your own unique identifier for the customer so when ComplyAdvantage performs the search, it's easier to identify the customer across platforms, reduce duplicated work, and simplify your processes.Include adverse media matches: When this option is selected, Maxsight displays instances of adverse media returned from ComplyAdvantage.

This option should only be selected if you have adverse media configured on your ComplyAdvantage account. If you select this option and adverse media is not configured on your ComplyAdvantage account, this check cannot run successfully and error messages are displayed.

To learn about how ComplyAdvantage classifies adverse media, see the help site for ComplyAdvantage.

Ignore historical matches: When this option is selected, Maxsight removes any matches that ComplyAdvantage previously listed as politically exposed or sanctioned but are not on any current lists.

Name settings for false positive reduction: This required option is one of three that contributes to Maxsight’s false positive reduction service. It determines how Maxsight treats results returned from ComplyAdvantage when a result’s name does not match the name on the profile. The value for the option must be one of the following: Allow any matches, Allow close or exact matches, or Allow exact matches.

Date of incorporation settings for Maxsight false positive reduction: This is one of three options required options that contributes to Maxsight’s false positive reduction service. It determines how Maxsight treats results returned from ComplyAdvantage when a result’s date of incorporation does not match the profile’s date of incorporation. The value for the option must be one of the following: Allow any matches, Allow close or exact matches, or Allow exact matches.

If the profile doesn’t have a date of incorporation, for example, the field was left blank, date of incorporation is not used as a factor in identifying false positives.

Country of incorporation settings for Maxsight false positive reduction: This is one of three options contributing to Maxsight’s false positive reduction service. It determines how Maxsight treats results returned from ComplyAdvantage when a result’s country of incorporation does not match the profile’s country of incorporation. The value for the option must be one of the following: Allow any matches, Allow close or exact matches, or Allow exact matches.

Note

To turn off Maxsight’s false positive reduction service, set the , , and options to Allow any matches.

ComplyAdvantage search profile configuration: Add the name of a ComplyAdvantage search profile, and the associated search filters, and any other configurable options, are applied by ComplyAdvantage to reduce false positive. This is optional with a direct agreement.

Caution

The name of a provider configured search profile cannot be used with the Include adverse media matches configuration option.

What we’ll need

Let us know that you’d like to add a Sanctions and adverse media screening check variant with ComplyAdvantage and let us know which configuration options you’d like to use. We’ll set it up for you.

We’ll also need you to:

Send us your ComplyAdvantage API key.

Create a ComplyAdvantage webhook with the URL we’ve sent you.

Learn how to get your API key and create a webhook.

Testing the configuration

We’re currently building the tests for this check variant.

Profile fields

These are the profile details searched in ComplyAdvantage’s sources:

Name | Description |

|---|---|

Company name ( *Required | The company’s name. |

Country of incorporation ( *Required | The country in which the company is incorporated. |

Customer reference ( Optional | The company's customer reference which ComplyAdvantage uses as their |

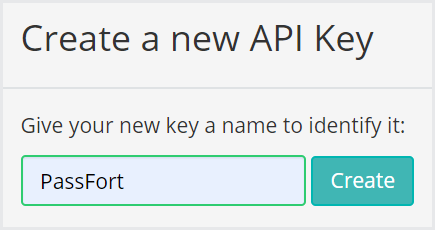

Get your ComplyAdvantage API key and create a webhook

To get your ComplyAdvantage API key:

Log into your ComplyAdvantage account.

Select the option from the menu.

Click .

Under , add a name for the key in the field provided. We recommend calling the key Maxsight, but it can have any name you choose.

Click . The key is created.

Send us the text displayed under .

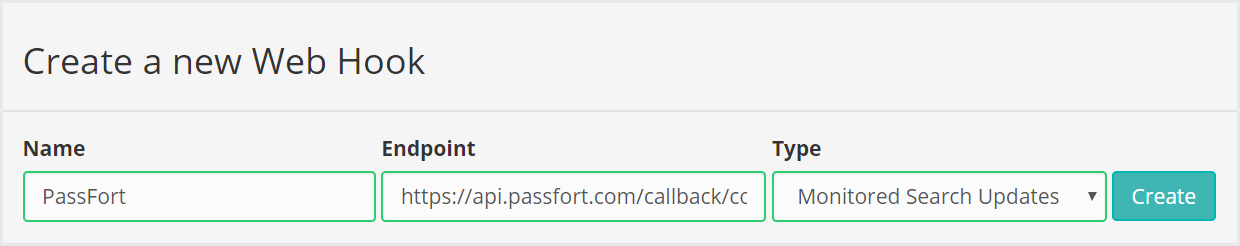

To create a webhook:

Log into your ComplyAdvantage account.

Select the option from the menu.

Click .

Under , add a name for the webhook in the field provided. We recommend calling the webhook Maxsight, but it can have any name you choose.

For the Endpoint, add the webhook URL:

https://api.passfort.com/callback/comply_advantage.Set the to .

Click .