About Passfort's checks

Use Passfort checks to help pass the due diligence tasks on a profile’s product application.

Checks replace the manual work that would otherwise be needed to get information from data providers, such as gathering all company filings from a corporate registry, or performing actions using data providers such as running an Electronic identity check.

There is a set list of checks that can be used for each task.

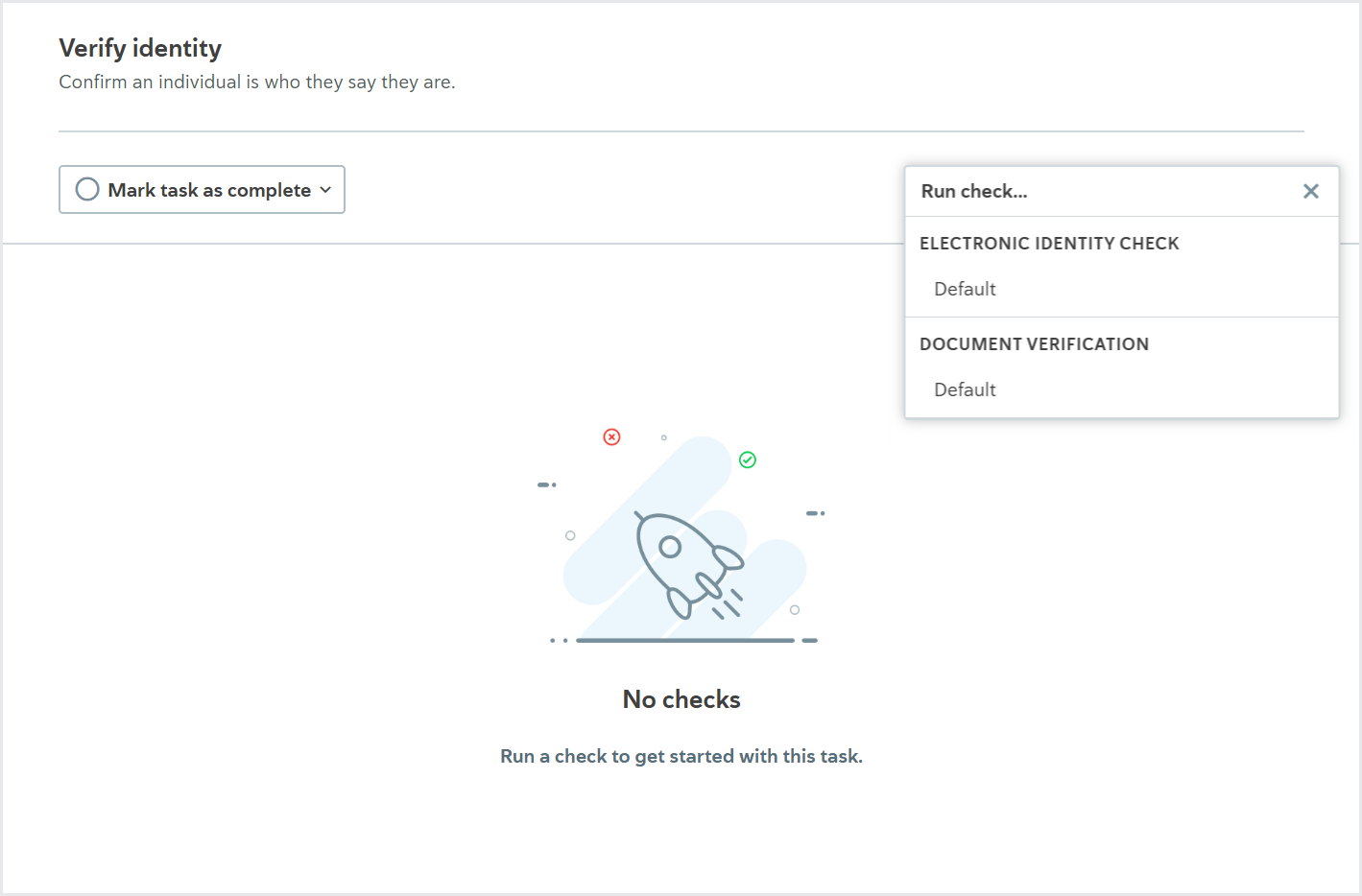

For example, there are two checks available for the Verify identity task that confirms an individual is who they say they are:

Electronic identity check: Establishes a digital paper trail for an individual.

ID verification: Confirms whether an individual’s proof of identity documents are valid.

When configuring your account, you choose which checks are enabled for your tasks.

Advanced checks

Some checks, such as running a Document verification check, may prompt you to perform more actions.

If you're running a PEPs, sanctions, and adverse media screening check, you can learn what to do with potential matches.

If a company is applying to your product, you may need to verify the company's associates, like officers, shareholders, trustees, or authorized persons. Learn how to About the associates verification list.

Checks frequently asked questions

Why are the check buttons grayed out?

You can only run checks on tasks that are not yet passed or failed. To make the task incomplete, click or . If the task is incomplete and the button is still grayed out, your company has not configured the check.

Why was there information in the check results already?

A colleague or the product's smart policy may have already run a check on the task. Remember that the results of a check may be different if you run it again. For example, if the individual has changed their address since the check was last run.

Why did the task pass automatically when I ran the check?

Your smart policy may be configured so that when a check passes, the task passes automatically.

About check variants

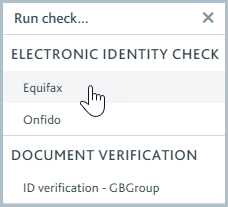

Each check you enable must have at least one check variant.

A check variant specifies:

Which data provider is used to run the check.

Whether any additional configuration options are applied to the check.

When a check has multiple variants, you can choose which variant you want to use. So, for example, you might choose to run a variant with a different data provider if the first variant you try doesn’t work.

When a check configured to run automatically has multiple variants, you specify which variant is tried first. You also have the option to configure the variants so that if the first one fails, returns an error, or returns a partial match, another is tried automatically, and so on. This is called waterfalling your check variants.

Additionally, you can specify that the check variant, and waterfall, are determined by the profile’s country. For example, you could specify that when the Company filings check is performed on a company incorporated in the UK, Companies House is always used as the data provider.

Every time a check variant is run, a permanent record of the information used to run the check variant and the results returned from the data provider are kept on the task, so you always know what happened to a profile. To learn more about how the check results are displayed, see the descriptions for each check.

The data provider determines which configuration options are available for the check. The links to the data provider configuration topics explain, in detail, how each data provider handles the check, including what information is sent to the data provider and what causes the check to pass, fail, or return a partial match by default, and which configuration options are available.

The configuration options to determine whether checks are run automatically and whether they cause tasks to pass automatically are set at the task level. Learn more about task configuration options.